14

2024

-

03

Analysis of the Opportunities Brought to the PCB Industry by the Rapid Development of Automatic Driving

The popularity of automotive electronics will promote the volume and price of automotive PCB (printed circuit board). In recent years, the trend of automotive electrification and electronics is obvious, and PCB is almost everywhere in automotive electronic systems.

The popularity of automotive electronics will promote the volume and price of automotive PCB (printed circuit board). In recent years, the trend of automotive electrification and electronics is obvious, and PCB is almost everywhere in automotive electronic systems.

▌ New energy vehicles and smart driving components will significantly increase the value of automotive PCB

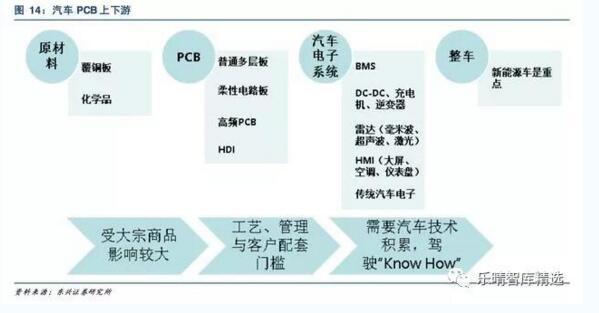

In recent years, the trend of automobile electrification and electronization is more and more obvious. As the backbone of electronic products, PCB manufacturing is also becoming increasingly important in the automotive supply chain. Compared with traditional fuel vehicles, the increased charging, energy storage, power distribution and voltage conversion equipment of new energy vehicles will bring a large number of new application scenarios to PCB.

At the same time, although autonomous driving above L4 cannot be mass-produced in a short period of time, the gradual penetration of a variety of intelligent driving components will bring rapid development opportunities to the application of high-end high-frequency PCBs in automobiles.

Large PCB applications: new energy vehicles

According to our calculations, in the field of powertrain and transmission alone, the value of PCBs on electric vehicles is as high as about 800 yuan, which is 20 times the value of PCBs in this field of traditional vehicles.

The new demand for electric vehicles mainly comes from powertrain-related equipment-on-board charger, battery management system (BMS), voltage conversion system (DC-DC, inverter, etc.) and other high-voltage and low-voltage devices.

A large number of high-voltage and high-power devices contained in new energy vehicles, such as IGBT and MOSFET, have higher requirements for heat dissipation, which makes the arrangement of PCB not too dense, and further increases the amount of PCB used in new energy vehicles.

For each new energy vehicle, the total PCB board required for the above-mentioned equipment alone reaches about 0.8 square meters.

However, the total PCB required for a medium-sized fuel vehicle is only about 0.43 square meters. In the internal combustion engine of traditional fuel vehicles and traditional systems, the amount of PCB used is very small, totaling only about 0.04 square meters.

Pay close attention to Le Qing think tank (website: www.767stock.com, public ID: lqzk767) for more in-depth industry research reports.

Automotive millimeter wave radar is an important driver of high-end PCB promotion

In smart driving devices, millimeter wave radars must be manufactured using high-frequency PCBs. The unit price of high-frequency PCB is several times that of ordinary PCB, and the value of single millimeter wave radar PCB can reach 100 yuan.

Automotive millimeter-wave radar mainly uses two frequency bands of 24GHz and 77~79GHz, and the frequency is much higher than that of general circuit usage scenarios.

The characteristics of high-frequency circuits determine that the requirements from the key raw materials of high-frequency PCBs-copper clad laminates to the manufacturing of PCBs are much higher than those of ordinary PCBs:

The transmission of high-frequency circuits is vulnerable to loss, which determines that PCB copper clad laminates must use special substrates such as PTFE.

The difficulty of high-frequency copper clad laminate determines the high added value of high-frequency PCB processing.

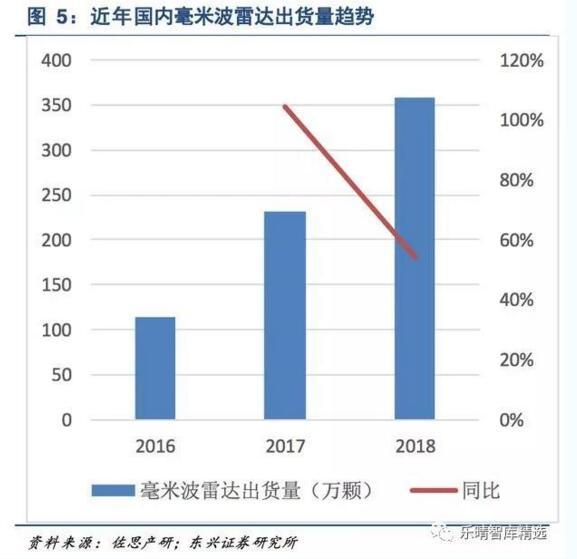

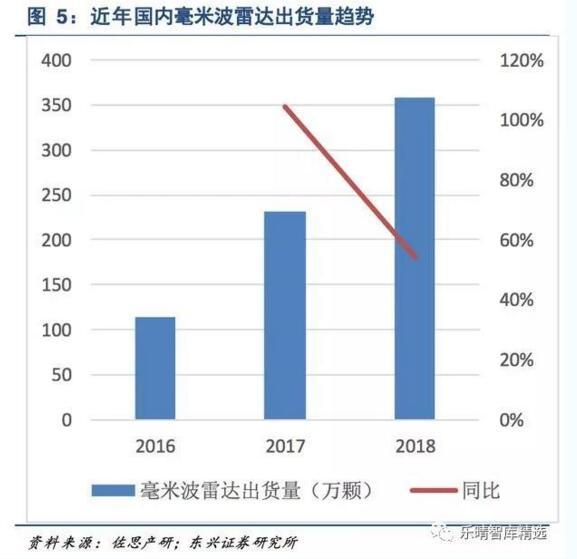

The application of domestic millimeter wave radar continues to grow at a high rate, with a year-on-year increase of about 54% in 2018. According to the calculation of Zoss Industry Research, the domestic millimeter wave radar shipments reached 3.58 million in 2018.

Generally, vehicles equipped with ADAS functions require 2-7 millimeter-wave radars, so domestic production of millimeter-wave radars in 2018 is about equivalent to 720000 vehicles equipped, with a penetration rate of about 3%.

Among them, the domestic 77GHz millimeter wave radar shipments exceeded 24GHz for the first time in 2018, becoming the mainstream. 77GHz has higher requirements for PCB due to its higher frequency.

Automotive PCB will rise in volume and price, far exceeding the industry growth rate

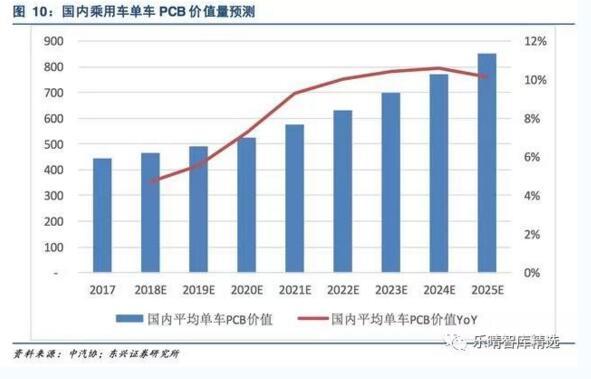

According to our calculation, the PCB consumption of new energy vehicles equipped with millimeter wave radar and large central control screen will reach 1.24 square meters, worth 1281 yuan, 3.6 times that of traditional fuel vehicles without the above configuration.

The main driving forces for the increase in the value of PCB bicycles include:

Popularization of new energy vehicles

Intelligent driving equipment, especially the application of millimeter wave radar

Perfection of Human-Computer Interaction System

Driven by new energy vehicles, the automotive PCB market will usher in long-term stable growth.

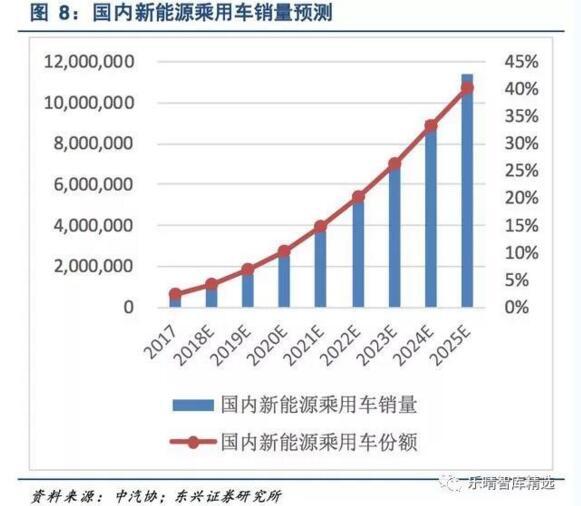

The production and sales of new energy passenger vehicles in China will continue to grow rapidly in the next few years, and the CAGR is expected to be about 40% from 2018 to 2025. The sales volume of domestic new energy passenger vehicles exceeded 1 million in 2018, and is expected to exceed 2.5 million by 2020 and close to 12 million by 2025, with a market share of more than 40%.

Millimeter wave radar is an important sensing device to realize intelligent driving and even automatic driving target, which has obvious advantages compared with other sensors.

The cost of millimeter wave radar is much lower than that of laser radar, and its range and adaptability to the environment are far better than that of cameras.

Although the penetration rate of domestic millimeter wave radar was only 3% in 2018, this proportion will rise rapidly in the next few years. We expect to reach 34% by 2025.

In addition to the above points, the complex and changeable environment that automotive products need to face also makes the performance and reliability requirements of automotive PCBs much higher than those of PCB products used in general consumer electronics.

Higher requirements make automotive PCBs require higher production yield than general PCBs. At the same time, automotive PCBs have higher requirements for drilling, etching and other process links, plus the added value of design and test verification, the unit price of products is higher than that of ordinary PCBs.

We forecast that the average value of single car PCB will rise from 464 yuan in 2018 to 850 yuan in 2025, with a CAGR of 9%.

According to the long-term CAGR = 2% of the total domestic passenger car sales, the year-on-year growth rate of new energy vehicles from 2018 to 2025 will gradually shrink from 60% to 30%. It is conservatively estimated that the domestic automobile PCB market will rise from 10.9 billion yuan in 2018 to 24.1 billion yuan in 2025, with a CAGR of 12% during the period.

Considering that many products of domestic PCB manufacturers are actually matched with vehicles sold overseas, the actual domestic automotive PCB market will grow faster.

It is estimated that by 2025, the global automotive PCB market will reach 58.3 billion billion yuan.

▌ China PCB's automotive business is beginning to take shape, with a considerable growth rate.

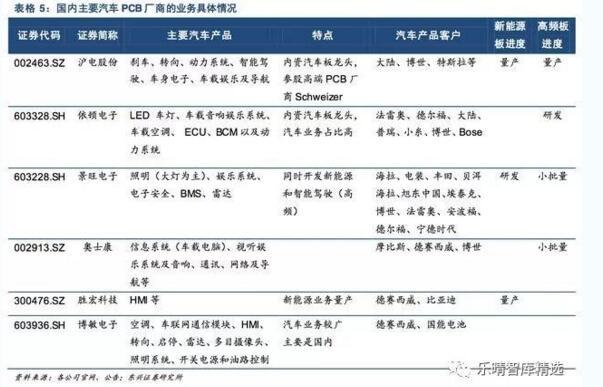

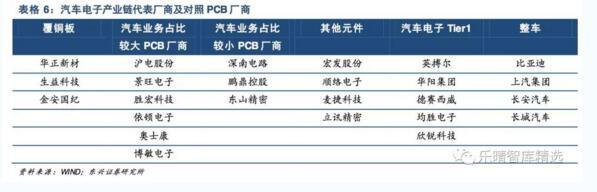

Several PCB manufacturers mainly increased revenue from automotive panels.

In recent years, the proportion of automotive business of A- share listed PCB manufacturers has increased significantly, with a number of PCB manufacturers accounting for more than 25% of the automotive business and accounting for most of the incremental revenue.

Judging from the absolute number of automobile businesses, Shanghai Electric Power Co., Ltd. and Eaton Electronics both expect their automobile business income to exceed 1.3 billion yuan in 2018. Among the listed companies, there are 5 automobile PCB businesses reaching 0.5 billion yuan, 2 more than in 2017. Among them, Shanghai Electric Power Co., Ltd. ranked 10th in the global automotive PCB business in 2017.

In 2018, the total business of the top 6 A- share listed companies in the automotive PCB business reached 5.3 billion billion yuan, up 32.7 percent year-on-year, and the growth rate continued to expand from 29.1 percent in 2017. Among them, the rapid growth of the automotive business includes Aoshikang, Bomin Electronics, Shenghong Technology and Jingwang Electronics.

The combined automotive business of the top six A- share listed companies in the automotive PCB business accounted for 23.9 percent of total revenue in 2018, up significantly from 22.1 percent in 2017 and continuing to be much higher than the market. According to the statistics of Prismark, an electronics industry consulting agency, the global automotive PCB accounts for about 10% of all PCB applications.

In terms of the contribution of the incremental automotive business to the incremental total revenue, the combined contribution of the top six A- share automotive PCBs in 2018 was 31.1 percent, significantly higher than the level of the world's major PCB manufacturers.

All of Eaton's new revenue was contributed by the automotive business (other businesses contracted), and the automotive business contributed 79% and 29% of the revenue growth of Auscon and Shanghai Electric, respectively.

China PCB enterprise automotive business layout improvement

Major domestic PCB manufacturers in the automotive information entertainment, lighting, powertrain and chassis (steering, braking) and other fields have been more perfect layout, a number of enterprises into the Valeo, Delphi, mainland, electric equipment, Preh (all wins electronics) and Desai Siwei and other mainstream Tier1 customer supply chain system.

In the field of PCB for new energy vehicles and millimeter wave radar, domestic manufacturers have not formed a scale for the time being, and there is a certain gap compared with international leading companies such as Schweizer and Jingpeng. However, there have been some breakthroughs in recent years, mainly in:

Shanghai Electric Power Co., Ltd. has obtained the production capacity of new energy vehicle powertrain PCB and millimeter wave radar high frequency PCB through equity participation in the Schweizer, and many projects have entered mass production. Jingwang Electronics and Aoshikang's high-frequency PCB are being supplied in small quantities, and Eaton Electronics is cooperating with downstream. Shenghong Technology's BMSPCB products match BYD and have been mass produced. Jingwang Electronics' BMSPCB products match Ningde era and are under development.

The competitive landscape of automotive PCB companies is better than downstream

Compared with the downstream, domestic PCB enterprises in the automotive industry to continue to break through the greater opportunity.

The automotive PCB manufacturing process does not directly involve the driving control field that Chinese companies are not good at and it is difficult to accumulate experience.

PCB manufacturers generally belong to the automotive Tier 2 or Tier 3 suppliers (Tier2 or Tier3), only directly to the system supplier (Tier1), more focused on manufacturing. Tier1 needs to undertake a lot of design and verification work.

Automotive electronic verification work requires complete consideration, exquisite design tests, and full verification of the operation of each subsystem under various extreme conditions (extreme working conditions, temperature, humidity, and the arrangement and combination of vibration environments). The accumulation of knowledge and technology in the driving itself requires extremely high requirements.

At present, the market concentration of Tier1, which involves intelligent driving, is relatively high. The main participants are only traditional global giants of auto parts such as Bosch, Mainland China and Japan Electric Equipment. Chinese manufacturers can only involve some businesses such as BMS (Junsheng Electronics, etc.), TPMS (Baolong Technology, etc.) and HMI (Desai Siwei, etc.) with limited value.

Compared with the chip field, the gap between Chinese enterprises in the PCB field and the international advanced level is small. At present, most automotive chips are monopolized by global giants such as NXP, Infineon and Renesas Semiconductor, and the share of Chinese chip manufacturers is extremely limited.

The downstream of PCB (e. g., PCBA business), which is both downstream of chip manufacturers and upstream of multinational Tier1 (sometimes OEMs), is bound to be squeezed by strong suppliers and strong customers, with limited bargaining power.

The business cycle of automotive PCB enterprises is better than upstream and downstream.

Comparing the net business cycle of each link in the automotive electronics industry chain since the end of 2017, we find that the net business cycle of automotive PCB companies is only higher than that of complete vehicles in each link, significantly better than other parts links, and significantly better than PCB manufacturers with little automotive PCB business.

The PCB industry is usually under greater cash flow pressure. Therefore, the better business cycle of these PCB companies that are biased towards the automotive business indicates that they have a certain degree of assurance in terms of both horizontal competitiveness and vertical bargaining power in the industry.

PCB production to domestic transfer, automotive PCB will follow

Since the new century, PCB production from the United States and Europe to the domestic transfer trend is obvious.

We believe that automotive PCBs, especially high-end PCBs, will also be transferred to the domestic market in the future, with greater opportunities for domestic manufacturers.

In 2000, China's PCB output value accounted for only 8.1 percent of the world's total, but by 2017 the proportion had reached 50.5 percent, making China the absolute main force in global PCB production.

Automotive PCB, like the traditional PCB business, is still dominated by US, Japanese and Taiwanese companies. Companies with high automotive PCB sales include Taiwan-funded Jingpeng, Jianding, US-funded Schindler (TTMTech.), and Japanese-funded CMK, Mingxing (MEIKO) and Qisheng. The automotive business accounts for a relatively high proportion and the new energy and high-frequency board business is mainly Jingpeng and Schindler.

The leading manufacturers of high-end automotive panels are mainly German Schweizer. The six major automotive PCB manufacturers listed on the-share market have a combined market share of 12.3 per cent, while Shanghai Electric and Eaton Electronics each have a share of about 2.5 per cent. We speculate that the combined market share of all A- shares and domestic automotive PCB manufacturers is about 20%.

As most downstream automotive Tier1 manufacturers are still in developed countries, the global share of automotive PCB domestic output is lower than that of ordinary PCBs.

In the future, with the gradual release of China's "engineer bonus", more car Tier1 production capacity will be moved into China, and the increase of domestic car PCB will also follow.

In 2018, the share of domestic PCB manufacturers in the global automotive industry increased significantly, and the share of the top 6 increased from 10% to 12%. The automotive PCB industry is close to monopolistic competition, and has not yet formed an oligopoly pattern. No manufacturer can control the price of the entire industry. Domestic PCB manufacturers still have a great opportunity to continue to expand their share.

Previous Page

Address: No.1, Quanchuang Road, Jiuhua Economic Development Zone, Xiangtan, Hunan

- --View all subsidiary--

Copyright: ISU Petasys Hunan Technology Co., Ltd.